Navigating the Orthopedic Industry’s Evolution: An Interview with Laurent Pruvost, CEO of Intech Medical

In this exclusive interview, we join Guillaume Viallaneix, Editor-in-Chief of The MedTech Digest, as he sits down with Laurent Pruvost, CEO of Intech Medical. Together, they cover Laurent’s impressive three-decade journey in the orthopedic industry. From his foundational days at Sofamor, now part of Medtronic, to his current leadership position at Intech, Laurent offers invaluable insights into the industry’s evolution. He reflects on the challenges and successes that have impacted him and explains the strategic blueprint that has positioned Intech as a global leader in surgical instrument manufacturing in Orthopedics.

Dive in to capture the unique perspective of an “Expert in Motion” on the ever-evolving world of orthopedics.

Guillaume: Laurent, it’s a pleasure to have you share your experience with The MedTech Digest. With over 30 years in the orthopedic industry, transitioning from Sofamor to Medtronic, and now as the CEO of Intech, your journey has been truly remarkable. Could you tell us how your adventure in this industry began and what path led you to your current position at Intech?

Laurent: Absolutely, Guillaume! I started the orthopedic industry with Sofamor in France, eventually acquired by Medtronic. During my tenure there, from 1992 to 1999, I was deeply involved in procurement, witnessing firsthand the industry’s evolving dynamics. After spending a year in Warsaw, IN, when Medtronic decided to close its French production site in 2000, Alain Degrave, Jean-Luc Malpiece, and I saw an opportunity to create Intech to fill the supplier gap in manufacturing of complex surgical instruments in the orthopedic market. We leveraged equipment left over after shutdown and saved as many jobs as we could.

Guillaume: Let’s talk about Intech’s evolution. How did you move from its modest beginnings to becoming the leading global manufacturer of surgical instruments in Orthopedics?

Laurent: From 2000 to 2012, the journey was a mix of intense yet exhilarating experiences. We started with just ten 17 people, a handful of machines, and a contract with Medtronic. Our primary goal was to expand our client base across France and the US. The market responded positively, and by 2005, our revenue had grown substantially, validating our know-how and strategy.

Guillaume: Financing plays a pivotal role in any venture. Could you shed some light on how you managed the financing during Intech’s early days?

Laurent: Initially, we bootstrapped with our own capital and secured support from a few local banks. However, the economic downturn of 2008-2009 posed a real threat. Even simply securing payroll seemed daunting, pushing us to seek a financial partner to stabilize our footing.

Guillaume: Did this phase lead to any significant financial ventures or partnerships?

Laurent: Indeed. We initiated a funding round, contemplating bringing a minority stakeholder on board. But upon reflection, we decided to maintain our path. Around 2012, with revenues of about 25 million euros, we knew a solid financial strategy was necessary for our next growth phase, particularly as we expanded in the US market and made it happen!

Guillaume: And all of this experience culminated in your current role as the CEO of Intech?

Laurent: Absolutely! I became CEO in 2012 with three main objectives. First, to ensure a solid managerial and financial transition. Second, to continue organic growth. Third, to make a structuring acquisition in the US. 10 years later, I have the privilege of leading an amazing team of over 1,200 employees in 9 production facilities across three continents. We are on target to generate over $180M in sales in 2023 and are more excited than ever about the journey ahead!

Guillaume: Impressive, to say the least! Laurent, the orthopedic industry has significantly changed over the last two decades. Could you share your observations on some key moments or shifts you’ve witnessed?

Laurent: One major evolution has been the consolidation within the industry. Initially, it was mainly OEMs consolidating, but manufacturers quickly followed suit. We saw that OEMs began seeking partners capable of navigating the industry’s increasing complexity. This complexity isn’t just about the products we bring to life but, most importantly, navigating the regulatory and quality standards that have become more stringent over time.

Guillaume: You just mentioned the regulatory environment, how have you seen it evolve, and what impact has it had on the industry globally?

Laurent: The industry has seen a surge in regulatory scrutiny, notably from the FDA in the U.S. and, under the MDR in Europe, but in reality, the trend is global. At Intech, working closely with major players like Medtronic and Stryker, we had to elevate our standards early to meet the increasingly demanding regulatory and quality standards. We actually managed to turn the regulatory pressure into an opportunity and a differentiator for Intech. (OK…)

Guillaume: Throughout the years we’ve known each other, two keywords always come up in our conversations – quality and passion. We’re not in a price war here, but a battle of quality and service, right?

Laurent: Indeed. Today, quality isn’t something we even need to mention; it’s a given. At Intech, we thrive on complexity, high-mix, low-volume production, and taking on challenges that our competitors shy away from. With the rise of minimally invasive surgery, dealing with complex products and varied volumes demands a nimble, creative, and innovative engineering team. It also requires skilled savoir-faire to run these machines.

Guillaume: True, it’s not about just producing large quantities of generic products but embracing the challenge of producing intricate, innovative products.

Laurent: Exactly. While large volumes might be the preferred route for many, we’ve built our reputation on our ability to handle technical challenges and produce complex products. With our backbone in Spine, we’ve always been dealing with intricate orthopedic devices. This background forced us to be a step ahead, adopting state-of-the-art technology. We’ve built a strong pipeline of legacy products, but all site managers will agree with me when I say NPI (New Product Introduction) is the name of the game. Our competitive advantage for new launches is upfront skilled engineering that guarantees smooth DFM (Design For Manufacturability), ensuring we shine in comparison to our competition. At this point, the conversation shifts from pricing to technical know-how and engineering, and this can’t be done in a vacuum.

Guillaume: Shifting gears a bit, you mentioned earlier that you always consider simplifying your customers’ lives. Can you tell me more about that?

Laurent: Yes, we’ve always aimed to simplify our clients’ lives. In addition to our tagline, “we tech care.”, our internal motto is “Dream big, stay simple.” This notion leads to creating customized solutions or co-developing products with our clients. This approach is gaining momentum. More clients seek our guidance during their development phase. Whether it is simply for guidance or co-development on major projects, the demand for custom-made products is growing. Comparatively, the automotive industry is ahead. For instance, 80% of the Volkswagen Golf was developed by Valeo. I foresee the Orthopedic industry will follow a similar model where OEMs lay down the broad ideas and strategic directions for optimal patient care, leaving the execution and delivery to experts such as us.

Guillaume: Moving onto the initial phase of your global expansion, when evaluating potential acquisitions, how do you balance the financial calculations with the qualitative aspects such as the team, product, and company values?

Laurent: It’s a blend of everything. Financial viability is crucial, but the qualitative aspects often make the real difference. For instance, during our first US acquisition, which was Turner Medical, we felt a strong connection with the team and shared values within the first ten minutes of the meeting. This human element and a viable financial structure led to a successful acquisition that propelled our growth in the U.S.

Guillaume: As an experienced CEO, Laurent, you’ve led other strategic M&A activities. Could you share your thought process and the key considerations you considered when evaluating potential acquisitions?

Laurent: The primary aspects are the four P’s – People, Products, Process, and Planet. It’s crucial to ensure a good fit and alignment across the board. Once we identify a promising target, it’s about pursuing it with passion, determination, and well-mapped-out synergies. For instance, we initially focused on geographic expansion by acquiring companies in the US and Malaysia to establish a global footprint, allowing us to serve local markets. After that, we switched our strategy evolved to expand our product offerings, which led to the integration of innovative Cases & Trays and Silicone Handles experts, namely Pyxidis and Bradshaw Medical.

Guillaume: In retrospect, how do you view the impact of these acquisitions on your company’s growth trajectory?

Laurent: They cannot be underestimated. Each acquisition opened up new markets, brought in complementary products, or added valuable expertise to our portfolio. It’s a continuous learning and adaptation journey, and today, it positioned us well in the global market.

Guillaume: Looking ahead, what’s on the horizon for your M&A strategy?

Laurent: We’re exploring multiple avenues. One aspect is looking into adjacent sectors like robotics, which are high-growth areas. The idea is to diversify and create different divisions within the company that cater to evolving market needs. We’re also open to acquiring or partnering with design or development firms to offer more comprehensive solutions to our clients.

Guillaume: Speaking of acquisitions, you emphasized the importance of adaptability during integration. How do you ensure that the integration process does not overshadow the core values or the main reasons for acquiring a company?

Laurent: The key to a successful acquisition lies in preserving the essence of why a company was acquired in the first place. It’s a delicate balance—introducing new processes without diminishing the acquired company’s unique value proposition. Every acquisition comes with challenges, and we are responsible for navigating these and keeping the core objectives intact.

Guillaume: It’s apparent that a blend of adaptability, open communication, and decisive leadership is crucial for navigating the complex terrain of acquisitions and market evolution. Any thoughts on how executives can better prepare for such endeavors?

Laurent: I’d say promote a culture of continuous learning and be prepared to adapt. The market will continue to evolve, and staying ahead requires a willingness to embrace change, learn from each endeavor, and continuously strive for better integration and collaboration strategies.

Guillaume: As we wrap up, can you tell us about some exciting projects Intech is working on?

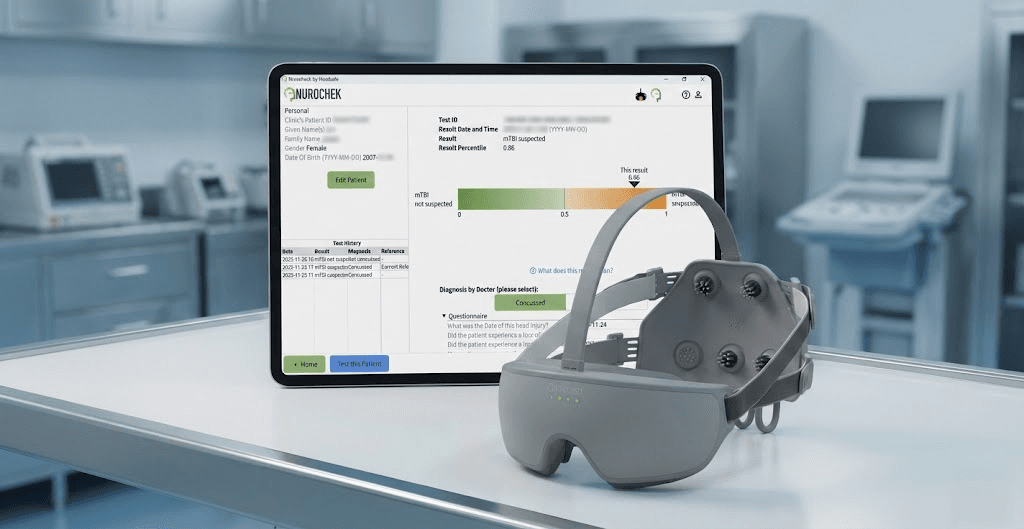

Laurent: Sure! SMADE is our latest venture, offering smart tracking solutions to Medical Device OEMs, transforming the asset management landscape. We’ve made trackers to locate surgical containers worldwide. Right now, we’re just tracking the trays at a macro-level, but soon enough, we’ll be tracking the instruments inside of them. The data mined from these trackers helps OEMs understand asset allocation as well as balance costs and revenue, thus optimizing the assets’ performance globally.

Several SMADE pilot projects are ongoing. I invite your readers to visit the SMADE site at https://www.smade.io/

Guillaume: It sounds like in everything you have been doing, there has been a balance between expansion, market responsiveness, and creating a positive work environment. Laurent, it’s been a fascinating discussion. Thank you for sharing these insights.

Laurent: It’s been a pleasure, Guillaume. Thank you.

Interested in hearing from more “Experts in Motion”? Take a look at more interviews in our Experts in Motion series.